Did you know that pet owners spend over $18,000 on vet care for their pets over their lifetime1? This is a huge amount. That’s why getting liberty pet insurance, pet health coverage, and animal protection plans is key for furry friend policies and veterinary expense insurance. Liberty Mutual offers top-notch coverage to shield your pet from unexpected vet costs. It ensures your pet stays healthy and happy.

Key Takeaways

- Liberty Mutual is a trusted name in pet insurance with years of experience.

- Their plans cover accidents, illnesses, and wellness. You can pick your deductible and how much you get back.

- Policyholders can choose from $5,000 to $15,000 in annual coverage limits. There’s a 14-day wait for claims.

- Liberty Mutual gives discounts to military, multi-pet families, and current customers.

- They don’t cover pre-existing conditions or some genetic and birth defects.

Understanding Pet Insurance

Pet insurance is a valuable tool in the world of pet care. It helps protect your furry friends. But what is it, and why should you get it2?

What is Pet Insurance?

Pet insurance covers the cost of vet care for your pet. It can pay back some of the costs for medical treatment. This includes accidents, illnesses, or routine care2.

Why Consider Pet Insurance?

Pet insurance offers financial protection and peace of mind. It ensures your pet gets the care they need without high costs2. In 2017, Liberty Mutual joined the pet insurance market. They are now among the big names like Progressive and Nationwide2.

An average policy from Liberty Mutual costs about $48 a month for dogs and $19 for cats2. They offer discounts for PEF members, military, and insuring multiple pets2.

Liberty Mutual has different plans to fit your budget. They offer a Basic Wellness plan for $9.95 and a Prime Plan for $24.952.

With Liberty Mutual, you know your pet is in good hands. They have a 30-day money-back guarantee and support six days a week2.

Understanding pet insurance and what Liberty Mutual offers helps you protect your pet and finances234.

Types of Pet Insurance Plans

Liberty Mutual offers pet owners a variety of insurance plans. Each plan is designed to fit your pet’s unique needs. You can choose from accident-only coverage to plans that include accident, illness, and wellness benefits. This ensures your pet gets the protection they need5.

Accident-Only Coverage

The accident-only plan covers unexpected injuries and accidents. This includes broken bones, cuts, or swallowing harmful objects. It’s a budget-friendly option for pet owners who want to avoid high medical costs6.

Accident and Illness Coverage

Liberty Mutual’s accident and illness plan covers injuries and common illnesses. This includes cancer, diabetes, or infections. It helps your pet get the tests, treatments, and meds they need for various health issues5.

Accident, Illness, and Wellness Coverage

The most complete plan covers accidents, illnesses, and wellness. It includes routine checkups, vaccinations, dental cleanings, and flea/tick prevention. This ensures your pet gets all-around care for their well-being5.

Liberty Mutual’s pet insurance plans are customized for your pet’s needs. They consider your pet’s breed, age, and location to offer competitive prices5. They also offer discounts for insuring multiple pets, seniors, and military members. This makes their plans more affordable6.

| Plan Type | Coverage | Deductible | Reimbursement | Annual Maximum |

|---|---|---|---|---|

| Accident-Only | Unexpected injuries and accidents | $250 to $1,0007 | Up to 90%7 | $5,000 to $15,0007 |

| Accident and Illness | Unexpected injuries, accidents, and common illnesses | $250 to $1,0007 | Up to 90%7 | $5,000 to $15,0007 |

| Accident, Illness, and Wellness | Unexpected injuries, accidents, common illnesses, and preventive care | $250 to $1,0007 | Up to 90%7 | $5,000 to $15,0007 |

“Liberty Mutual’s pet insurance plans offer complete coverage. They ensure your furry friend gets the care they need, no matter the situation.”

How Pet Insurance Works

When your pet needs medical care, filing a claim with Liberty Mutual is easy. You pay the vet bills first. Then, you send the claim to Liberty Mutual. After approval, you get back a part of the costs, minus your deductible89.

The amount you get back and your deductible depend on your policy. Liberty Mutual has different plans, like accident-only and accident and illness810.

Liberty Mutual’s policies have a 14-day wait for all claims, including wellness910. This rule helps avoid covering pre-existing conditions. Coverage limits range from $5,000 to $15,000, and you can pick deductibles and reimbursement rates8910.

Premiums vary based on your pet’s breed, age, and where you live. In New York City, dog coverage costs $48.65 to $71.10 monthly. Cat coverage is $25.40 to $31.508.

Pet insurance costs can go up due to inflation and local pet care prices. Annual price changes are made8.

Choosing the Right liberty pet insurance Policy

Choosing the right pet insurance is key. Liberty Pet Insurance lets you customize coverage for your pet’s needs.

Deductibles and Reimbursement Rates

Liberty Mutual has three deductible choices: $250, $500, or $1,000 a year11. This helps you pick a plan that matches your budget. You can also choose how much you want to pay back, from 70% to 90%1112.

Coverage Limits and Exclusions

Liberty Mutual offers coverage up to $5,000, $10,000, or $15,000 a year12. It’s vital to check what’s not covered, like pre-existing conditions or certain treatments11. This ensures your pet gets the care they need.

| Deductible Options | Reimbursement Rates | Annual Coverage Limits |

|---|---|---|

| $250, $500, or $1,000 | 70%, 80%, or 90% | $5,000, $10,000, or $15,000 |

Think about deductibles, reimbursement rates, coverage limits, and exclusions when picking a Liberty Pet Insurance policy1112. This way, you can find the best protection for your pet.

“Every six seconds, a pet parent is handed a bill for more than $3,000. Liberty Mutual Pet Insurance can help you be prepared for the unexpected.”12

Benefits of Pet Insurance

Owning a pet brings joy, but medical emergencies can be costly. Pet insurance offers financial protection and peace of mind for pet owners.

Financial Protection

Pet insurance helps cover unexpected vet bills. It covers accidents, illnesses, and preventive care. This means your pet’s health is protected, no matter what13. For example, Liberty Mutual’s plans cover many medical costs, including accidents and illnesses14.

Peace of Mind

Pet insurance also gives you peace of mind. It reduces stress and worry about your pet’s health15. This lets you focus on caring for your pet without financial worries.

Whether you’re new to pet ownership or have had your pet for years, pet insurance is a wise choice. It ensures your pet’s well-being, allowing you to enjoy their love and companionship fully.

Factors to Consider

Choosing the right pet insurance involves several key factors. Your pet’s age, breed, and any pre-existing conditions are important. These can affect the cost and what’s covered.

Your Pet’s Age and Breed

Older pets and some breeds may face more health problems. This can change how much you pay and what’s covered. It’s smart to look closely at the policy and think about how your pet’s age and breed might impact it.

Pre-Existing Conditions

Pre-existing conditions might not be covered. It’s important to check the policy to see if your pet’s needs are included. Knowing how the policy handles pre-existing conditions helps you decide if it’s right for your pet.

| Factors to Consider | Impact on Pet Insurance |

|---|---|

| Pet Age | Older pets may have higher premiums and limited coverage options |

| Pet Breed | Certain breeds may be more prone to health issues, affecting coverage and costs |

| Pre-Existing Conditions | May be excluded from coverage, requiring careful review of policy details |

“Choosing the right pet insurance policy requires careful consideration of your pet’s unique needs and characteristics. By understanding the impact of age, breed, and pre-existing conditions, you can find the coverage that best protects your furry friend.”

Remember, the factors to consider for pet insurance, such as your pet’s age and breed, as well as any pre-existing conditions, can greatly impact the cost and coverage of your policy. Take the time to thoroughly review the policy details to ensure you find the right fit for your pet.16

Comparing Pet Insurance Providers

When picking pet insurance, it’s key to look at different providers. You should think about the types of plans, coverage limits, deductibles, and how much they pay back. Also, check for any discounts17. This research will help you find the best and most affordable policy for your pet17.

Let’s dive into some top pet insurance providers and what they offer:

- Lemonade covers up to $100,000 a year and pays back 70% to 90%17.

- Figo has unlimited coverage and pays back 70% to 100%17.

- Spot offers unlimited coverage and pays back 70% to 90%17.

- MetLife covers up to unlimited and pays back 50% to 90%17.

- AKC covers up to unlimited and pays back 70% to 90%17.

| Provider | Annual Coverage | Reimbursement Rates | Rating | Cost | Waiting Periods |

|---|---|---|---|---|---|

| Pets Best | Unlimited | 70% to 90% | 5.0 | $48 | 3 days for accidents, 14 days for illnesses, 6 months for cruciate ligament conditions |

| Embrace | Unlimited | 70% to 100% | 4.6 | $76 | Immediate coverage for accidents, 14 days for illnesses, 6 months for orthopedic conditions |

| ManyPets | Unlimited | 70% to 90% | 4.6 | $49 | 15 days for accidents and illnesses, or 24 hours if switching from another insurer |

| Figo | Unlimited | 70% to 100% | 4.4 | $60 | 1 day for accidents, 14 days for illnesses, 6 months for orthopedic conditions |

| Lemonade | $100,000 | 70% to 90% | 4.3 | $52 | Immediate accident coverage, 14 days for illnesses, 30 days for cruciate ligament issues |

| AKC | Unlimited | 70% to 90% | 4.0 | $56 | 2 days for accidents, 14 days for illnesses, 180 days for cruciate ligament conditions and intervertebral disc disease |

| Healthy Paws | Unlimited | 70% to 90% | 4.0 | $55 | 15 days for accidents and illnesses, 12 months for hip dysplasia |

By looking at these factors, you can choose the best pet insurance for you18. The goal is to find a policy that covers everything well and fits your budget17.

When researching pet insurance companies, you’ll find over twenty options in the U.S19.. Think about customer ratings, coverage limits, how much they pay back, and the cost18. By carefully comparing, you can make sure your pet gets the best care17.

“Choosing the right pet insurance plan can provide invaluable peace of mind and financial security for your beloved companion.”

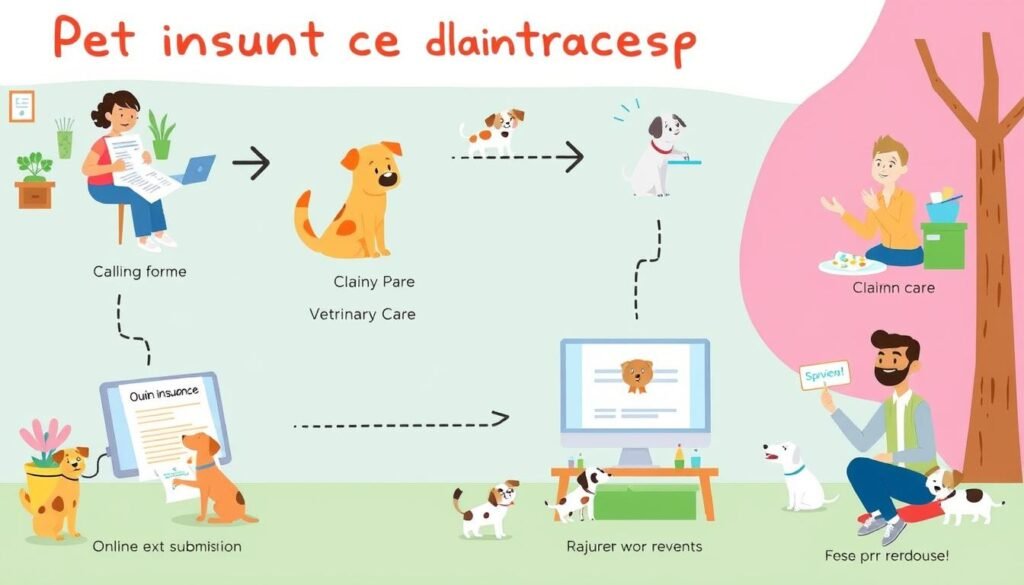

Filing a Claim with Liberty Pet Insurance

Filing a pet insurance claim with Liberty Pet Insurance is easy. If your pet needs medical care, you’ll first pay the vet bills. Then, you’ll send a claim to Liberty Mutual for reimbursement20.

You can submit your claim online, by email, or by mail20. This makes it simple and convenient for you.

Liberty Mutual aims to pay claims within 10 business days after they’re submitted20. For quicker payments, you can choose direct deposit. This sends money straight to your bank account20.

The claim process is straightforward. Just give details about the vet visit, like the diagnosis and costs20. Liberty Mutual might ask for medical records or invoices to check your claim20.

Having all your information ready makes the process smoother20.

Liberty Mutual cares about making you happy. They work hard to make the claims process easy. This way, you can focus on your pet’s health2.

To start a claim with Liberty Pet Insurance, call their claims team at20 1-844-525-246720. They’ll help you and make sure your claim is handled quickly. The sooner you file, the faster you’ll get your money back20.

Conclusion

Liberty Pet Insurance offers a wide range of coverage to protect your pet. With over a century of experience21, they provide 24/7 support21. They cover accidents, illnesses, surgeries, tests, and meds21. They also give discounts for insuring more than one pet21.

Liberty Mutual is a top pet insurance provider in the U.S21.. Their plans fit different needs, from basic to full coverage22.

Understanding pet insurance is key. Look at deductibles, rates, limits, and what’s not covered22. This helps choose the best Liberty Mutual policy for your pet. You’ll get financial security and peace of mind.

Liberty Mutual’s plans work for all pets, young or old, with or without health issues22.

When looking at pet insurance, compare what different providers offer. Liberty Mutual has a lot of experience21, great service, and wide coverage21. You can trust them to care for your pet.

Choose Liberty Pet Insurance to protect your pet’s health and happiness. It’s a smart investment in their well-being.

FAQ

What is pet insurance?

Why should I consider pet insurance?

What types of pet insurance plans does Liberty Mutual offer?

How does the pet insurance claim process work with Liberty Mutual?

What factors should I consider when choosing a Liberty Mutual pet insurance policy?

What are the benefits of having pet insurance?

How do my pet’s age and breed affect the cost and coverage of the plan?

Source Links

- Protecting Your Best Furry Friend with Pet Insurance – https://libertygroupllc.com/radio-show/protecting-your-best-furry-friend-with-pet-insurance/

- Is Liberty Mutual Pet Insurance Good? Here’s How It Stacks Up – https://www.pawlicy.com/blog/liberty-mutual-pet-insurance/

- Liberty Mutual Pet Insurance Review 2024 – https://www.forbes.com/advisor/pet-insurance/liberty-mutual-pet-insurance-review/

- Liberty Mutual Pet Insurance – https://www.marketwatch.com/guides/pet-insurance/liberty-mutual-pet-insurance-reviews/

- Liberty Mutual vs. Fetch (formerly Petplan) Pet Insurance – https://www.petinsuranceu.com/liberty-mutual-vs-fetch-formerly-petplan-pet-insurance/

- Liberty Mutual vs. Petplan Pet Insurance – https://www.freeadvice.com/insurance/liberty-mutual-vs-petplan-pet-insurance/

- The 8 Best Cheap Pet Insurance Companies 2024 | Bankrate – https://www.bankrate.com/insurance/pet-insurance/best-cheap-pet-insurance-companies/

- Liberty Mutual Pet Insurance Review: Is It The Right Choice For Your Pet? – https://www.businessinsider.com/personal-finance/pet-insurance/liberty-mutual-pet-insurance-review

- Liberty Mutual Pet Insurance Review 2024: Pros and Cons – NerdWallet – https://www.nerdwallet.com/p/reviews/insurance/liberty-mutual-pet-insurance

- Liberty Mutual Pet Insurance 2024 Review | Bankrate – https://www.bankrate.com/insurance/pet-insurance/liberty-mutual/

- Compare Liberty Mutual Pet Insurance – https://www.pet-insurance-university.com/compare_liberty_mutual_pet_insurance.html

- Liberty Mutual Pet Insurance – PEF Membership Benefits Program – https://pefmbp.com/insurance/pet-insurance/

- PetCare | Liberty Insurance Singapore – https://www.libertyinsurance.com.sg/petcare

- Liberty Mutual vs. Pets Best Insurance – https://www.petinsuranceu.com/liberty-mutual-vs-pets-best-insurance/

- Best Pet Insurance Companies | Bankrate – https://www.bankrate.com/insurance/pet-insurance/best-pet-insurance-companies/

- Liberty Mutual Pet Insurance Review 2024 – https://www.pet-insurance-university.com/review_of_liberty_mutual_pet_insurance.html

- The 5 Best Cheap Pet Insurance Companies for 2024 – NerdWallet – https://www.nerdwallet.com/article/insurance/cheap-pet-insurance

- Best Pet Insurance Companies Of October 2024 – https://www.forbes.com/advisor/pet-insurance/best-pet-insurance/

- No title found – https://www.petinsurancequotes.com/compare/

- How to File a Claim with Liberty Mutual – https://callfob.com/blog/liberty-mutual-report-a-claim/

- Liberty Mutual vs. Fetch (formerly Petplan) Pet Insurance – https://www.freeadvice.com/insurance/liberty-mutual-vs-fetch-formerly-petplan-pet-insurance/

- Liberty Mutual Pet Insurance Review – Protect My Paws – https://protectmypaws.com/liberty-mutual-pet-insurance-review/